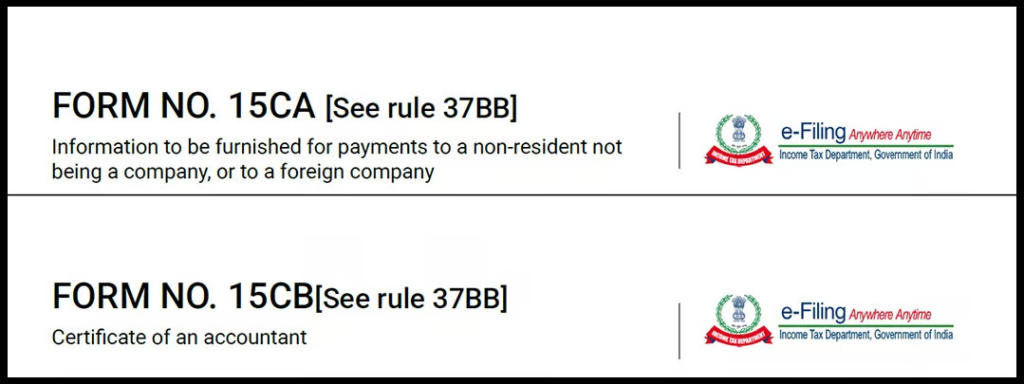

Remittance of Money From India to Abroad in relation to NRIs, OCIs remittance of money from NRO Account to NRE Account or Foreign Bank Account, bank requires form 15CA 15CB. These two forms are submitted online with the Income Tax Department.

Key Aspects of NRI Repatriation

1. Repatriation From NRO to NRE/Foreign Bank Account

- Common Scenarios: Income from investments (e.g., rent, interest), sale of property or mutual funds, or gifts received from relatives.

- Bank Compliance: Banks require submission of Form 15CA/15CB to process such transactions.

2. Payment to Non-Residents (TDS U/S 195)

- When making payments to non-residents (e.g., consultancy fees, royalties), TDS is applicable on income elements.

- Our services ensure accurate calculation of TDS, filing of requisite forms, and adherence to Double Taxation Avoidance Agreements (DTAAs).

3. RBI Guidelines

- One Million Dollar Scheme: NRIs/PIOs can repatriate up to USD 1,000,000 per financial year without RBI approval.

- Assistance with additional documentation for transactions exceeding this limit.

Form 15CA & 15CB Filing Process

- Form 15CB: CA-certified document verifying income details and applicable taxes.

- Form 15CA: Declaration submitted online, based on Form 15CB.

- Submission Timeframe: Typically 1–3 days.

Required Information:

- Details of remitter, beneficiary, and transaction.

- Tax details, RBI remittance codes, and DTAA benefits (if applicable).

- Supporting documents such as bank statements, ITRs, and property sale records.

Our Value Proposition

- Dedicated Team: Experienced professionals handling NRI tax and regulatory matters.

- Efficient Services: Fast-track processing for remittance and compliance.

- Customized Advice: Tailored strategies for tax planning and error-free documentation.

- Comprehensive Support: Assistance with asset management, lower TDS certificates, and representative services in India.

FAQs

1. Why are Form 15CA/15CB required for NRIs?

These forms ensure compliance with RBI and Income Tax regulations, even when remitting non-taxable income.

2. Can remittance be processed without these forms?

No. Banks mandate submission of Form 15CA/15CB for all outward remittances from NRO accounts.

3. Do NRIs need to be physically present in India for this process?

No. The entire process, including form submission and bank communication, can be managed remotely.

Request for Assistance – Form 15CB/15CA Filing for NRO Remittance to Germany

Dear Team,

I hope this message finds you well.

My name is Rajat Kapoor, and I am an NRI currently residing in Germany. I wish to transfer funds from my HDFC NRO account in India to my German bank account, and I understand that this process requires assistance with Form 15CB certification and Form 15CA filing as per Indian tax regulations.

Here are the details of my remittance request:

Purpose of Remittance: Transfer of income earned in India (e.g., rental income/savings) to personal account abroad

Bank: HDFC Bank (NRO Account)

Amount to be Remitted: Approx. ₹ 10 lacs

Destination Country: Germany

PAN: will provide later

I would appreciate your help in:

Issuing Form 15CB after reviewing my documents and confirming tax compliance

Assisting with or guiding me through Form 15CA filing on the income tax portal

Advising me on any applicable taxes or documentation requirements

Please let me know:

Your charges for this service

The list of documents you require from my side

Estimated timeline for completion

Looking forward to your response. Please feel free to reach out via email or WhatsApp/phone if needed.

Best regards,

Rajat Kapoor